ASN Duurzaam Mixfonds will be merged into ASN Duurzaam Mixfonds Neutraal

ASN Impact Investors has decided, in the interest of investors, to merge ASN Duurzaam Mixfonds with ASN Duurzaam Mixfonds Neutraal and subsequently liquidate ASN Duurzaam Mixfonds.

As we have also been offering ASN Duurzaam Mixfonds Neutraal – a fund with the same risk indicator and a greater spread – since 2017, ASN Duurzaam Mixfonds will be discontinued on 15 September 2021. Existing investors in ASN Duurzaam Mixfonds may automatically move to ASN Duurzaam Mixfonds Neutraal.

Main reasons for the discontinuation

The main reasons for discontinuing ASN Duurzaam Mixfonds are transparency in the fund range and diversification in the Mixfonds portfolio. Despite the fact that the mix of asset categories (equities and more defensive investments such as bonds) is the same for both ASN Duurzaam Mixfonds and ASN Duurzaam Mixfonds Neutraal (approximately 45% in equities and 55% in more defensive investments), their content is different with ASN Duurzaam Mixfonds Neutraal.

This can be confusing for investors and we want to solve this by merging ASN Duurzaam Mixfonds into ASN Duurzame Mixfonds Neutraal. ASN Duurzaam Mixfonds Neutraal forms part of a series of five sustainable mixfondsen with different risk-return profiles, from very defensive to very offensive. The ability to offer a selection of sustainable mixfondsen for different risk-return profiles was not the only improvement in 2017 on the already existing sustainable mixfonds:

- In the ASN Duurzaam Mixfonds Neutraal, the more defensive investments are divided between ASN Duurzaam Obligatiefonds and ASN Microkredietenpool. Microcredit has very different characteristics than government bonds, which reduces the expected volatility and increases the expected return of the bond portfolio. This allows for a better implementation of the cushioning effect of bonds in a portfolio with equities.

- In addition, the spread of the equity investment in this fund is greater due to the fact that the equity investment is also divided between ASN Milieu & Waterfonds and ASN Duurzaam Small & Midcapfonds.

What does the discontinuation mean for the existing investors in ASN Duurzaam Mixfonds?

The current investors in ASN Duurzaam Mixfonds can automatically move to ASN Duurzaam Mixfonds Neutraal or make a different choice. Because their situation has changed, for example, as a result of which they now prefer a Sustainable Mixfonds with a different risk profile. Investors are free to withdraw or switch to one or more other ASN investment funds free of charge. The progressive and extensive sustainability policy applies to all investment funds offered by ASN Impact Investors.

Fund costs

The fund costs of ASN Duurzaam Mixfonds Neutraal amount to 0.90% per annum and those of ASN Duurzaam Mixfonds to 0.65% per annum.

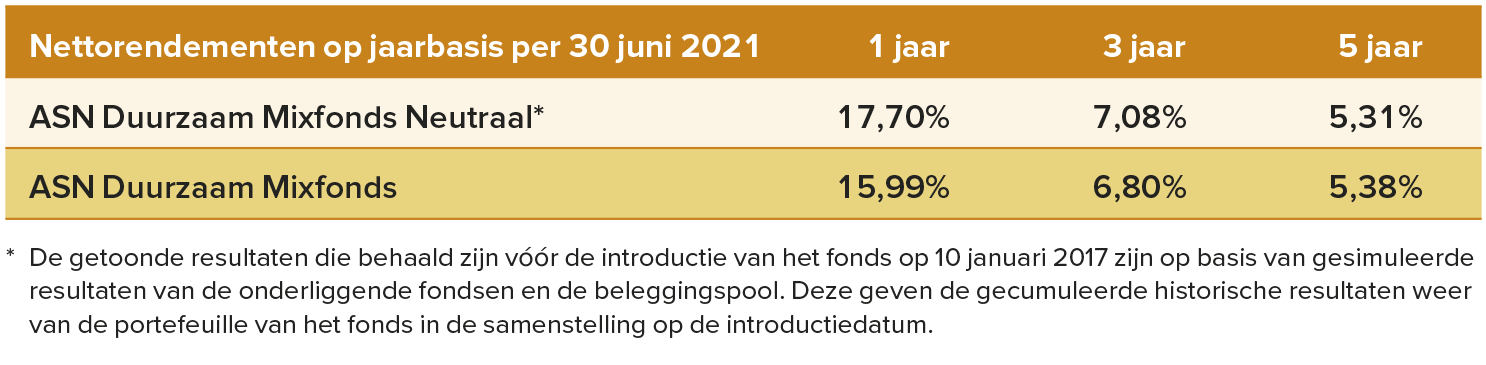

Comparison of net return (after costs)

The net return of a mixfonds is determined by the result of the investments minus the costs of the mixfonds. The table shows the net returns after deduction of the costs of the respective mixfonds.

All funds in which the new series of mixfondsen invests have a long track record: The ASN-Novib Microkredietfonds celebrated its 25th anniversary on 14 June 2021, ASN Milieu & Waterfonds its 20th anniversary on 2 July 2021 and ASN Duurzaam Small & Midcapfonds its 15th anniversary on 9 May.

For more information, please download the explanatory notes, which can also be found on the announcements page.

Any questions?

Then please contact us via info@asnimpactinvestors.com or via contact